The coronavirus pandemic has hit nearly everyone in the pocket, not least of which those looking to fund a start-up.

Yet, now may be the perfect time to invest for those able to put money into a product or solution. That’s why competitions like the Texas A&M New Ventures Competition are taking on increased importance during the COVID-19 crisis.

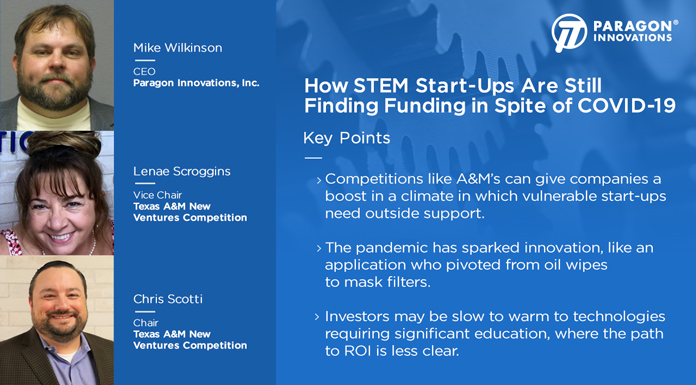

“I think investors always look for something unique and different. Whenever there’s a down time or some negative thing in the economy, whether it be 9/11 or this pandemic, it’s an opportunity to find things that will solve problems that pandemic or situation has occurring,” said Mike Wilkinson, who in addition to serving as the CEO of Paragon Innovations also sits on the Board of Directors for the Aggie Angel Network.

But even while savvy investors are looking to fund some of the best ideas, the economic downturn caused by the pandemic has made it difficult to secure that funding. With the Texas A&M New Ventures Competition going virtual this year but continuing its awards, start-up owners were even more excited than usual to see their hard work recognized.

“Their want and their need and excitement to compete was palpable, really,” said Lenae Scroggins, Vice Chair of the competition. “I haven’t had quite as much conversation in the previous years with teams … (but) we were able to continue the conversation and we were able to pivot in a couple of months and go from 300-400 people in the football field box suits to pivot to a 100% virtual competition .. (It was) really quite a feat.”

“They were so excited we were committed enough to the economy of the state of Texas that we were willing to put in the extra work.“

The extra work can pay off in the long run for investors who may be able to fund a product that truly does something different than anything else on the market.

While others may produce better short-term returns, funding STEM projects can lead to big-time home runs, said Chris Scotti, Chair of the competition.

“If you think about a software start-up, an app, and your path to market, your path to revenue is much shorter than a deeply complex start-up that has to go through tons of prototypes and testing,” he said. “From an investor standpoint, when you look at someone and say, ‘Oh, they’ve produced this thing,’ or it’s producing some early revenue, even if they’re not profitable, they’re producing some revenue.”

“That’s easier for your traditional investor to understand, whereas a technology that needs a ton of R&D before it can get to market, something game-changing that might be a total change to the way you do things … that’s harder for an investor to engage in.”

Yet, it may lead to the solution to a pandemic or the next technology to come out of a crisis.